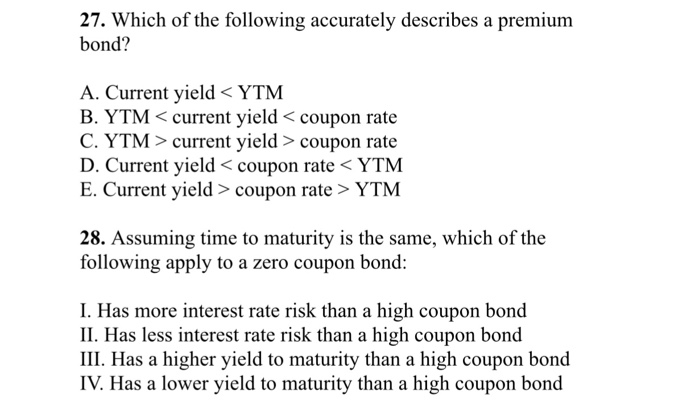

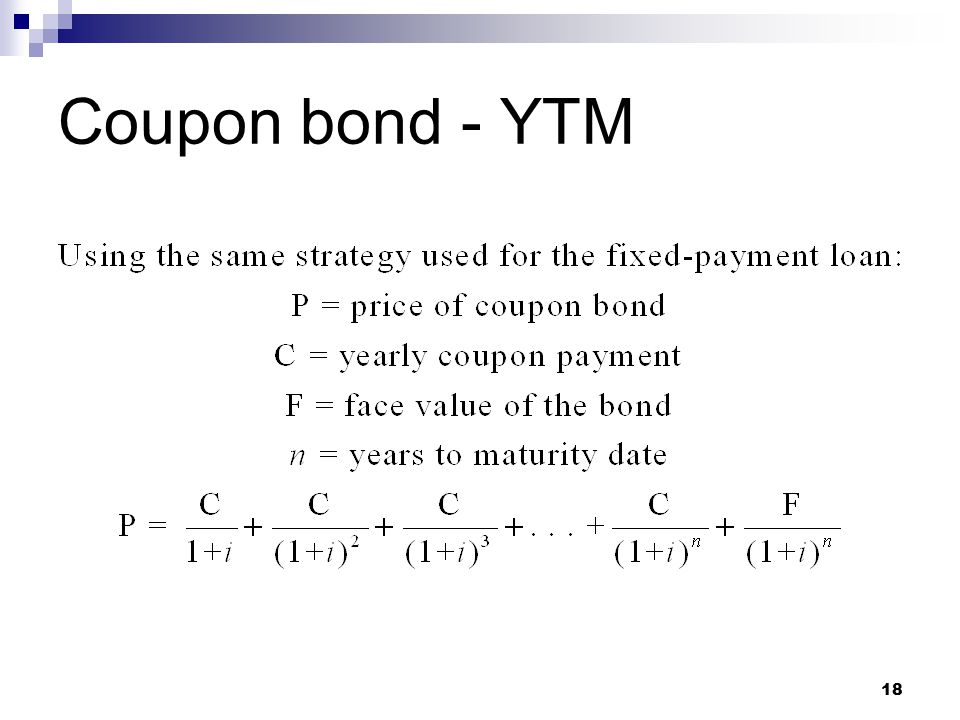

41 yield to maturity coupon bond

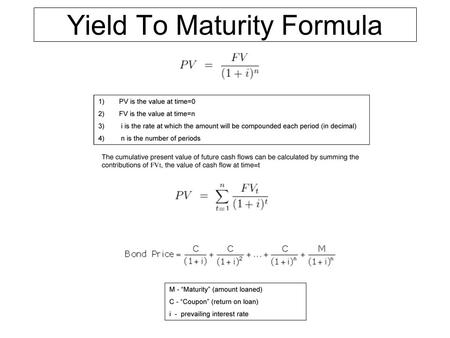

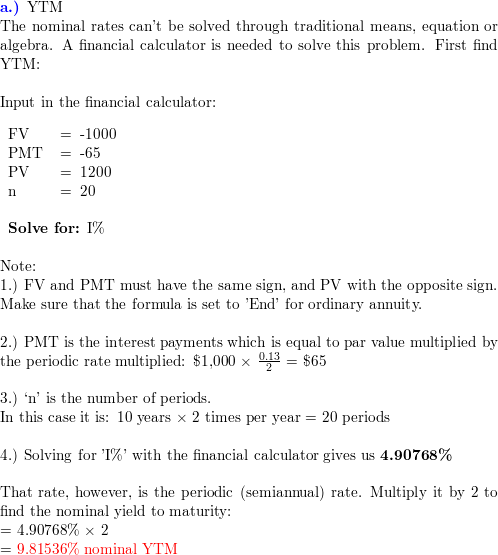

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity Formula - Study.com Dec 16, 2021 · Here is an example of a $100 zero-coupon bond with a two-year maturity date, and the current value of the bond is $90. ... (YTM) for the bond. Yield to maturity, also known as book yield or ...

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Yield to maturity coupon bond

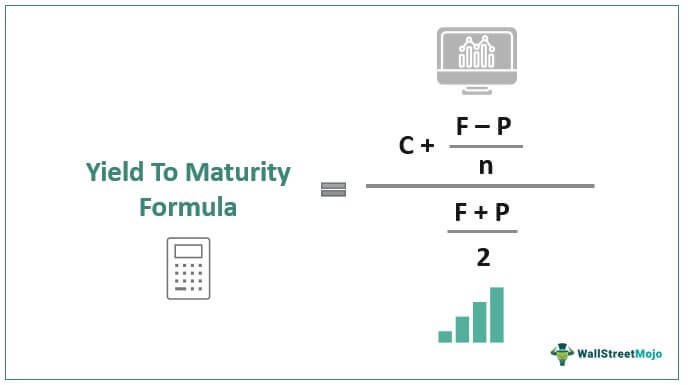

Yield to Maturity Calculator | YTM Calculator The yield to maturity is the annualized rate of return using any appreciation or depreciation from the bond, as well as annual coupon payments. Total Coupon Cash Flow: The total cash flow from the interest or coupon payments received by the investor over the "years to maturity." Bond Yield to Call (YTC) Calculator - DQYDJ Yield to worst on a non-callable bond is exactly equal to the yield to maturity. On a callable bond, it is the lower of the yield to maturity and yield to call. For other calculators in our financial basics series, please see: Compound Interest Calculator; Present Value Calculator; Compound Annual Growth Rate Calculator; Bond Pricing Calculator Bond Yield Formula | Calculator (Example with Excel Template) The term “yield to maturity” or YTM refers to the return expected from a bond over its entire investment period until maturity. YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM.

Yield to maturity coupon bond. Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond Yield Formula | Calculator (Example with Excel Template) The term “yield to maturity” or YTM refers to the return expected from a bond over its entire investment period until maturity. YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Bond Yield to Call (YTC) Calculator - DQYDJ Yield to worst on a non-callable bond is exactly equal to the yield to maturity. On a callable bond, it is the lower of the yield to maturity and yield to call. For other calculators in our financial basics series, please see: Compound Interest Calculator; Present Value Calculator; Compound Annual Growth Rate Calculator; Bond Pricing Calculator Yield to Maturity Calculator | YTM Calculator The yield to maturity is the annualized rate of return using any appreciation or depreciation from the bond, as well as annual coupon payments. Total Coupon Cash Flow: The total cash flow from the interest or coupon payments received by the investor over the "years to maturity."

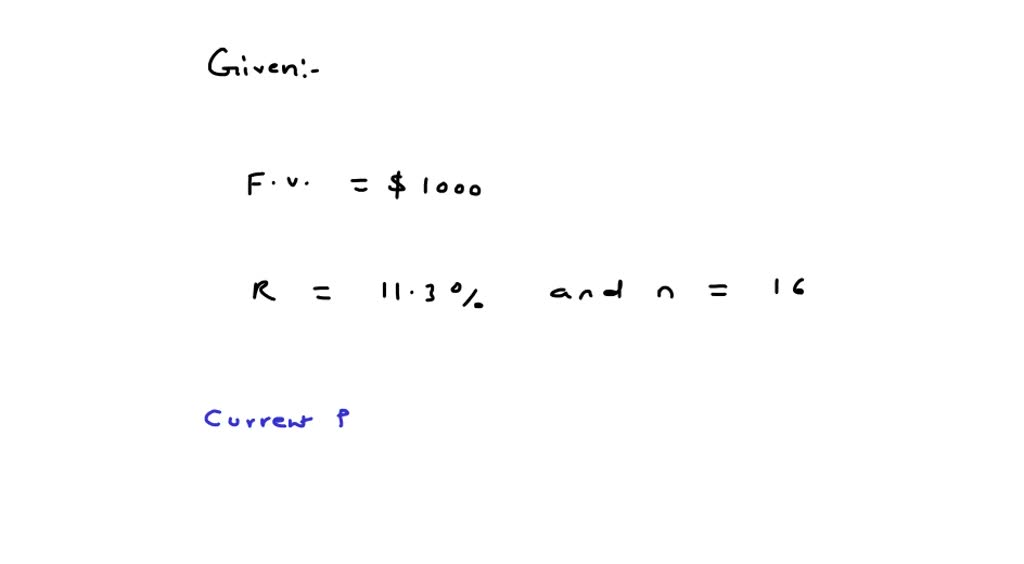

Ted's Co. offers a zero coupon bond with an 11.3% yield to maturity. The bond matures in 16 years. What is the current price of a $1,000 face value bond

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "41 yield to maturity coupon bond"