42 t bill coupon rate

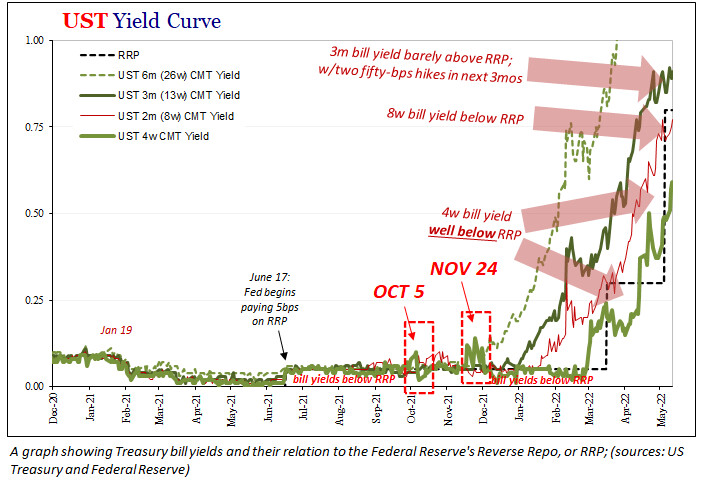

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Personal Finance: Short-Term T-Bill Interest Rates Are Way Up - Bloomberg The shortest-term T-bill lasts just a month and is offering a rate of 2.6%, according to Bloomberg data. Three-month bills are paying 3.2% and one-year bills a generous 4.1%. It was 0.04% on a one ...

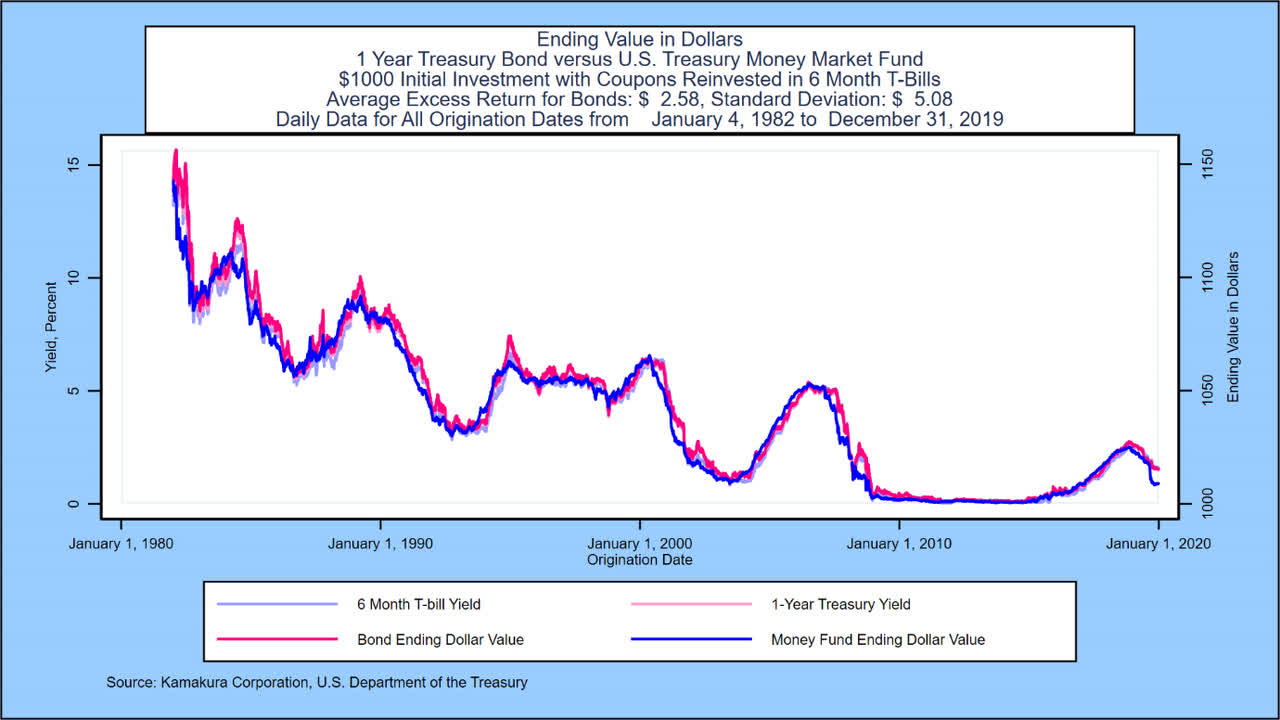

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

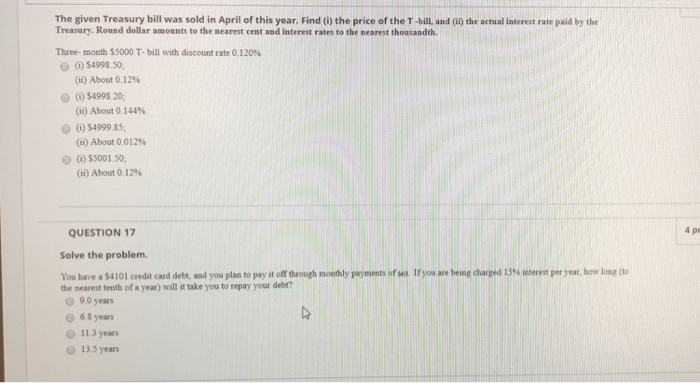

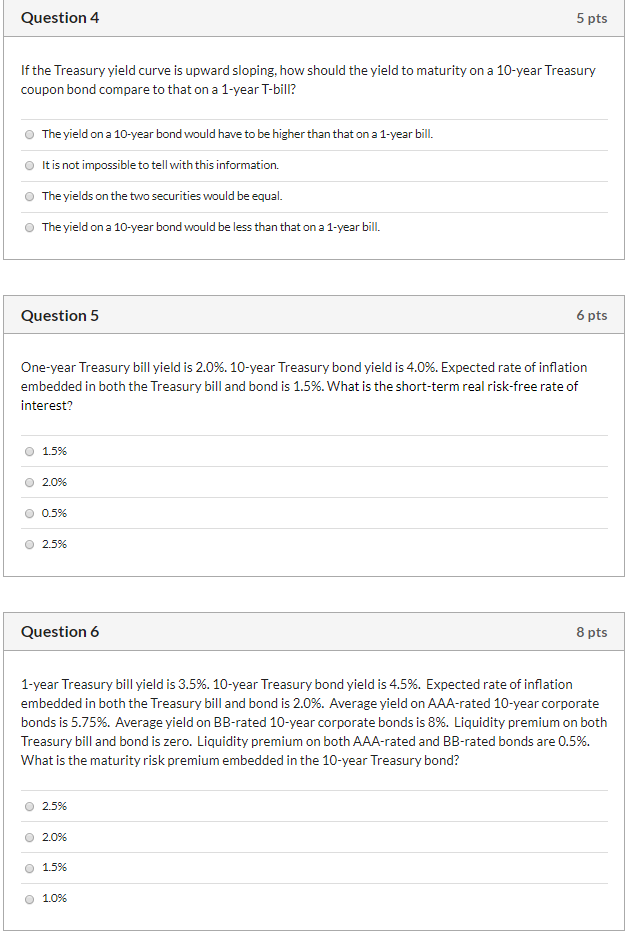

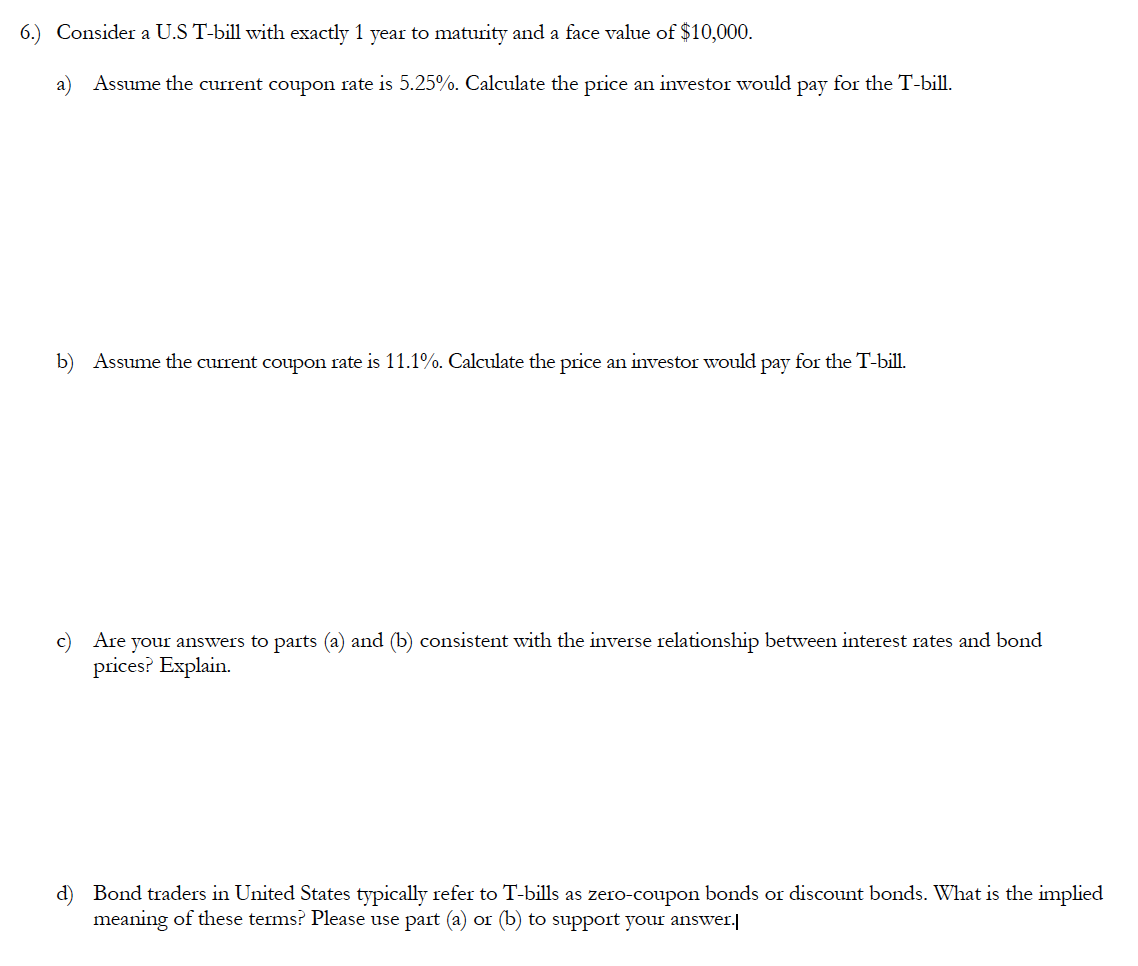

T bill coupon rate

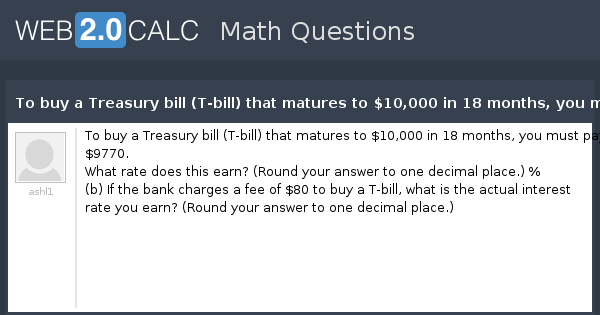

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box. Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Day Range 3.813 - 4.034 52 Week Range -0.376 - 4.215 Price 3 26/32 Change -1/32 Change Percent -0.46% Coupon Rate 0.000% Maturity Sep 7, 2023 Performance Change in Basis Points Yield Curve - US...

T bill coupon rate. How To Read A T-Bill Quote - Investopedia The bidprice represents the interest ratethe buyer wants to be paid for the bond. Converting the bid into an actual price requires a bit of work. 4*100/360=$1.11 $10,000-$1.11=$9,998.89 In this... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities of 2,... Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security. Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ... Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016 Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates ... COUPON EQUIVALENT 13 WEEKS BANK DISCOUNT COUPON EQUIVALENT 26 WEEKS BANK DISCOUNT COUPON EQUIVALENT 52 WEEKS BANK DISCOUNT COUPON EQUIVALENT 1 Mo 2 Mo 3 Mo 20 Yr 30 Yr; 01/02/2002: N/A : N/A US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index... 91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders... The Basics of the T-Bill - Investopedia There are auctions featuring different maturities every week except the 52-week T-Bill, which is sold every four weeks. 2 For example, a T-Bill with a maturity of 26 weeks might be sold every week...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch TMUBMUSD06M | A complete U.S. 6 Month Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

Individual - Treasury Bills: Rates & Terms Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Day Range 3.813 - 4.034 52 Week Range -0.376 - 4.215 Price 3 26/32 Change -1/32 Change Percent -0.46% Coupon Rate 0.000% Maturity Sep 7, 2023 Performance Change in Basis Points Yield Curve - US...

Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

Post a Comment for "42 t bill coupon rate"