42 coupon rate and yield

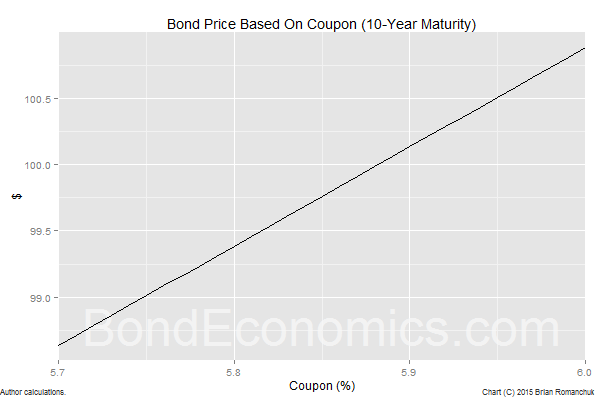

ICE BofA US High Yield Index Effective Yield (BAMLH0A0HYM2EY) View data of the effective yield of an index of non-investment grade publically issued corporate debt in the U.S. ... of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets ... Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel.

10-year government bond yield by country 2022 | Statista Of the major developed economies, Italy had the highest yield on 10-year government bonds at this time with 4.45 percent, while Japan had the lowest at 0.24 percent. Yield on 10-year government...

Coupon rate and yield

Credit Suisse Announces Coupon Amount on its Credit Suisse S&P MLP ... * The "Current Yield" equals the current quarterly Coupon Amount, annualized and divided by the Closing Indicative Value of the ETN on September 30, 2022. † The Current Yield, which is based on the... 11% Dividend Yield And 38% Upside | Seeking Alpha S-Yield = Stripped Yield - Shown in Charts Coupon = Initial Fixed-Rate Coupon FYoP = Floating Yield on Price - Shown in Charts NCD = Next Call Date (the soonest shares could be called) Note: For... Best CD Rates for October 2022 - Investopedia The current national average is just 0.46% annual percentage yield (APY). Today's top-paying institution, however, will pay you 3.21% APY on that same one-year commitment—that's almost seven times...

Coupon rate and yield. Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 2.152% yield. 10 Years vs 2 Years bond spread is 32.6 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... Because today's real yield was nearly double the coupon rate, buyers got it at a substantial discount — an unadjusted price of about $94.27 for $100 of par value. This TIPS will have an inflation index of 1.01972 on the settlement date of Sept. 30, so investors bought an additional 1.97% of principal, plus about 13 cents of accrued interest ... USOI Dividend Yield 2022 & History (Credit Suisse X-Links Crude Oil ... 7 Stocks to Buy to Outrun Rising Interest Rates; 7 Mid-Cap Stocks That Can be the Perfect Fit at Any Time; 7 Blue-Chip Dividend Stocks That Won't be Impacted by Rising Interest Rates; 7 Stocks with the Pricing Power to Push Through High Inflation; 10 Recession-Proof Stocks That Will Let You Wait Out the Bear; News. Real-Time News Feed ... PRESS RELEASE: Financial Stability Oversight Council Releases Report on ... WASHINGTON — The Financial Stability Oversight Council (Council) today released its Report on Digital Asset Financial Stability Risks and Regulation. The Council voted to approve the report in response to Section 6 of President Biden's Executive Order 14067, "Ensuring Responsible Development of Digital Assets." As called for by the Executive Order, the report reviews financial ...

Remarks by Secretary of the Treasury Janet L. Yellen at Financial ... As Prepared for Delivery On behalf of the entire Council, I'd like to express my thanks and appreciation for the hard work of our staffs. And I'd like to thank members of the Council for your attention and partnership on this effort. I know that there has been tremendous effort on this report since March. The Council works to identify, address, and foster resilience to vulnerabilities in ... Daily Treasury Yield Curve Rates - YCharts Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the ... US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 15 hours ago, on 6 Oct 2022 Frequency daily Description These yield curves... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.775% yield. 10 Years vs 2 Years bond spread is -39.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

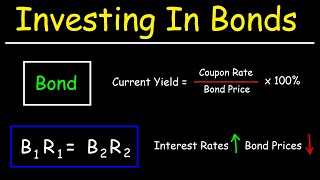

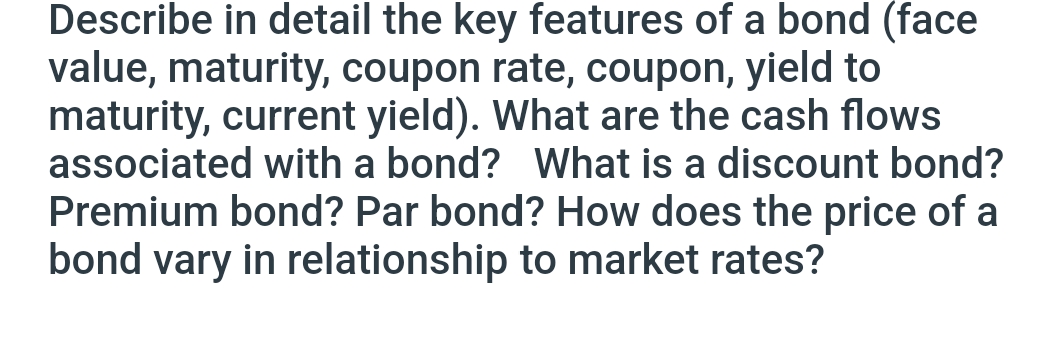

Bonds slump as JP Morgan Chase holds off its inclusion in EM index ... The widely traded 10-year G-Sec (coupon rate: 6.54 per cent) closed 57 paise down at ₹93.80 (previous close: ₹94.37), with its yield surging about 9 basis points to close at 7.4763 per cent (7 ... What Is Duration of a Bond? - TheStreet Definition - TheStreet For example, if interest rates rose by 2%, a 10-year Treasury with a coupon of 3.5% and a duration of 8.4 years would fall in value by 15%. Long-Term Bonds Let's use the 30-year Treasury with 4.5%... Weekly Forecast, September 30, 2022: Market Rate Expectations Step Up This week's simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is up 1 percentage point, from 1% to 2%. There is a 24.89% probability that the 3-month... Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

October 2022 30 Year Fixed | Fannie Mae october 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a / a. date: time: 10-day: 30-day: 60-day: 90-day: 10/03/2022: 08:15

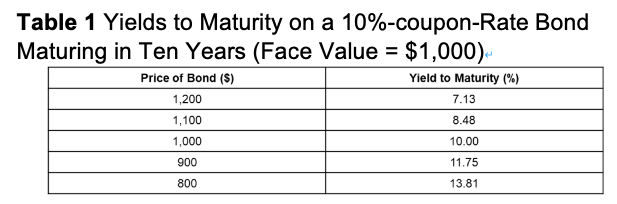

YTM - BrainMass 1) Bond prices and yields Assume that the Financial Management Corporations $ 1,000- par- value bond had a 5.700% coupon, matured on May 15, 2017, had a current price quote of 97.708, and had a yield to maturity ( YTM) of 6.034%. Given this information, answer the following questions. a. What was the dollar price of the bond? b.

Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate : Call Date: * Coupon Rate (%): * Call Price ($): * Latest Price ($): * Yield to Call: %

Calculation Bond Value - BrainMass Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.2% (annual payments). The yield to maturity on this bond when it was issued was 6.1%. Assuming the yield to maturity remains constant, what is the price of the bond immediately ... Solution Summary

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the purchaser of the bond.

Yield to Call Calculator | Calculating YTC | InvestingAnswers To calculate a bond's yield to call, you'll need to know the: face value (also known as "par value") coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

U.P. Power Corporation Limited 10.15% - Bond - ICICI Direct Check out U.P. Power Corporation Limited 10.15% - latest yield and coupon rate as on Date. Visit ICICI Direct know more. Stocks ... Coupon rate 10.15% Face Value 1,000,000. Maturity date 19-Jan-2024. Last Traded Price 1041800.0 . Last Traded Date 04-Oct-2022. Key Metrics ...

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 10 Year Treasury (US10Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

U.S. Treasury Bond Overview - CME Group Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on yields of the most recently auctioned Treasury securities at key tenor points across the curve. ... Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections ...

Bonds - MunicipalBonds.com New York Yield Curve. Maturity Year Number of Trades Average Yield Dollar Volume; 2022: 18: 2.712: $520,000 2023: 135: 3.198: $23,868,038+ 2024: 236: 3.226: $31,360,000+ ... Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from State Income Taxes; How to Look at a Bond for Sale;

Treasury Coupon Rate Question : r/investing - reddit.com Bond yields are pretty volatile. Generally the treasury wants a price close to 100 and a yield in even .25% increments. The auction works out the details. So for example the last 3 year auction was Sept 8th for Sept 15th delivery. Yield was 3.5% and price was 99.819428 for a total return of 3.54%. More posts you may like r/AskPhysics Join

Best CD Rates for October 2022 - Investopedia The current national average is just 0.46% annual percentage yield (APY). Today's top-paying institution, however, will pay you 3.21% APY on that same one-year commitment—that's almost seven times...

11% Dividend Yield And 38% Upside | Seeking Alpha S-Yield = Stripped Yield - Shown in Charts Coupon = Initial Fixed-Rate Coupon FYoP = Floating Yield on Price - Shown in Charts NCD = Next Call Date (the soonest shares could be called) Note: For...

Credit Suisse Announces Coupon Amount on its Credit Suisse S&P MLP ... * The "Current Yield" equals the current quarterly Coupon Amount, annualized and divided by the Closing Indicative Value of the ETN on September 30, 2022. † The Current Yield, which is based on the...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "42 coupon rate and yield"