44 calculate coupon rate in excel

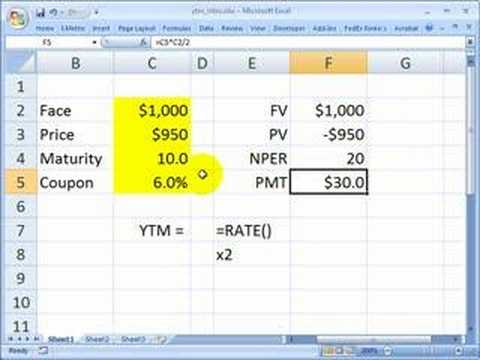

Discount Rate Formula | How to calculate Discount Rate with ... Discount Rate = 2 * [($10,000 / $7,600) 1/2*4 – 1] Discount Rate = 6.98%; Therefore, the effective discount rate for David in this case is 6.98%. Discount Rate Formula – Example #3. Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate. Using RATE function in Excel to calculate interest rate - Ablebits.com Monthly payments: nper = years * 12. Quarterly payments: nper = years * 4. To get an annual interest rate, multiply a periodic interest rate returned by the function by the number of periods per year. Monthly payments: annual interest rate = RATE () * 12. Quarterly payments: annual interest rate = RATE () * 4.

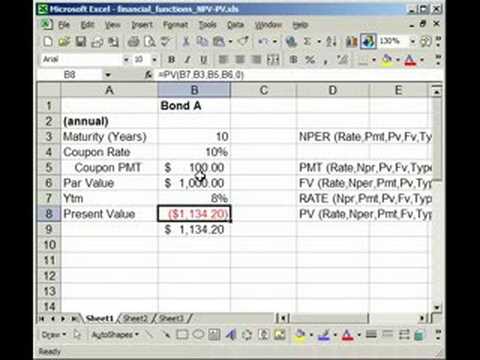

Excel Calculating the Price of an Annual Coupon Bond - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Calculate coupon rate in excel

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Calculation of zero-coupon discount rate for 2 year - Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

Calculate coupon rate in excel. Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Calculate the Interest or Coupon Payment and Coupon Rate of a Bond ... Microsoft Office Excel: Calculate the Interest or Coupon Payment and Coupon Rate of a Bond: 4:50: Microsoft Office Excel: Calculate the Length (Years to Maturity) and Number of Periods for a Bond: 5:04: Microsoft Office Excel: Calculate the Present Value of a Bond with Semiannual or Quarterly Interest Payments: 12:56: Microsoft Office Excel How to Calculate Discount in Excel: Examples and Formulas In detail, the steps to write the calculation process of the discounted price in excel are as follows: Type the equal sign ( = ) in the cell where you want to place the discounted value Input the original price or the cell coordinate where the number is after =. Then, type in a minus sign ( - ) Required Rate of Return Formula | Calculator (Excel template) Step 4: Finally, the Required rate of return is got by applying the values which were forecasted as shown below. Required Rate of Return = Risk-Free Rate + Beta * (Whole Market Return – Risk-Free Rate) Dividend Discount Model: On the other hand, the following steps help in calculating the required rate of return by using the alternate method ...

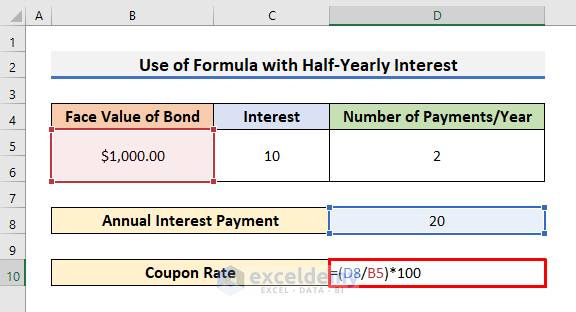

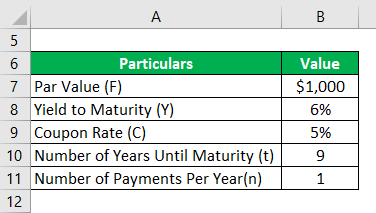

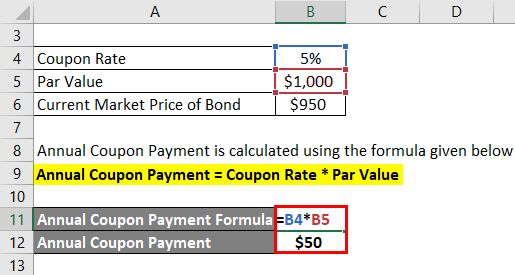

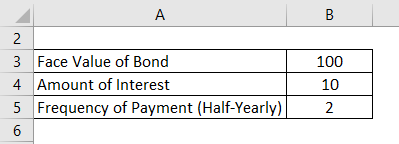

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel Calculate a Forward Rate in Excel - Investopedia This can be otherwise written as "= (100 x 1.04)" in Excel. It should produce $104. The final two-year value involves three multiplications: the initial investment, interest rate for the first year... How Do I Calculate Yield in Excel? - Investopedia Jul 08, 2021 · To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., A1 through A3).

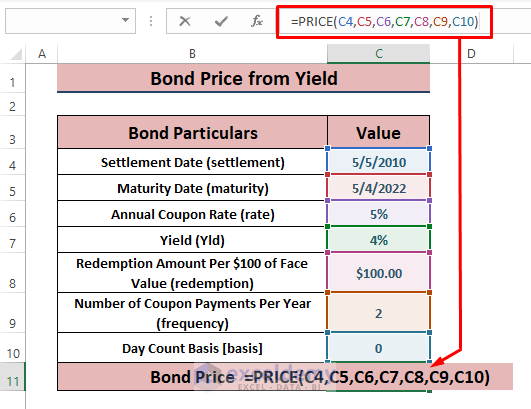

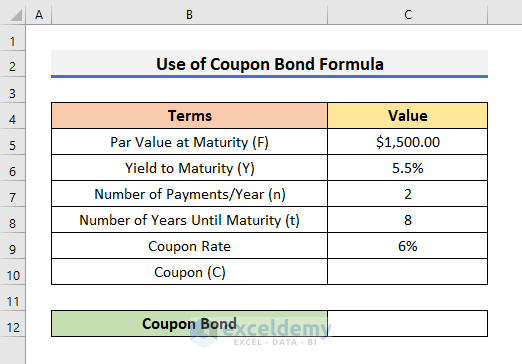

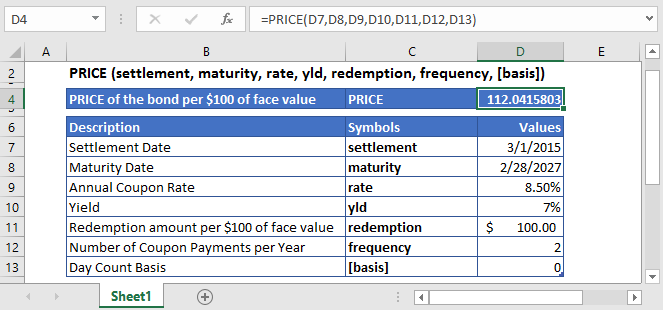

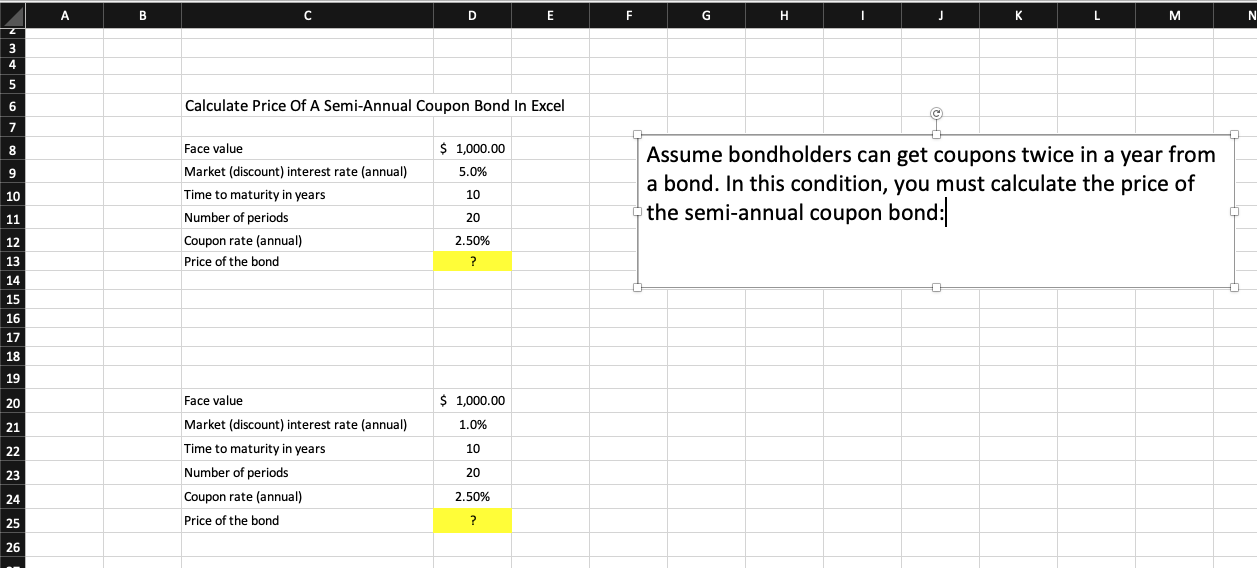

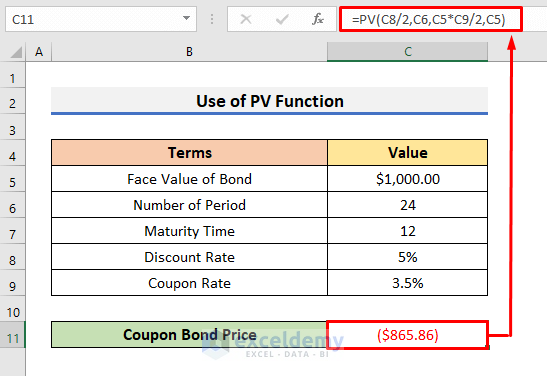

How to Calculate Bond Price in Excel (4 Simple Ways) In the formula, rate = F8, nper = F7, pmt = F5*F9, [fv] = F5. 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ... How to Calculate Commissions in Excel with VLOOKUP The job of the VLOOKUP is to find the rep's sales amount in the rate table, and return the corresponding payout rate. For this example our commissions plan looks like the following: Rep sells $0-$50,000, they earn 5%. Rep sells $51,000-$100,000, they earn 7%. Rep sells $100,001-$150,000, they earn 10%. Rep sells over $150,001, they earn 15%.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to calculate discount rate or price in Excel? - ExtendOffice Select a blank cell, for instance, the Cell C2, type this formula =A2- (B2*A2) (the Cell A2 indicates the original price, and the Cell B2 stands the discount rate of the item, you can change them as you need), press Enter button and drag the fill handle to fill the range you need, and the sales prices have been calculated. See screenshot:

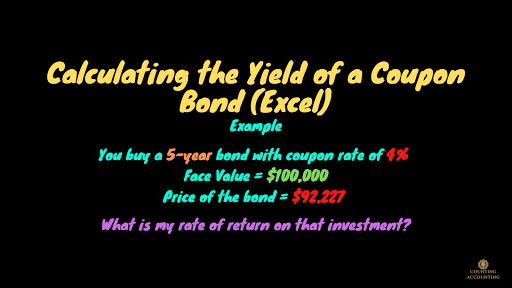

How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

Using Excel formulas to figure out payments and savings Using the function PMT (rate,NPER,PV) =PMT (5%/12,30*12,180000) the result is a monthly payment (not including insurance and taxes) of $966.28. The rate argument is 5% divided by the 12 months in a year. The NPER argument is 30*12 for a 30 year mortgage with 12 monthly payments made each year.

How to use the Excel RATE function | Exceljet Example. To calculate the annual interest rate for a $5000 loan with payments of $93.22 per month over 5 years, you can use RATE in a formula like this: = RATE(60, - 93.22,5000) * 12 // returns 4.5%. In the example shown, the formula in C10 is: = RATE( C7, - C6, C5) * C8 // returns 4.5%. Notice the value for pmt from C6 is entered as a negative ...

3 Ways to Calculate Bond Value in Excel - wikiHow Enter the following values in the corresponding cells to test the functionality of the bond yield calculator. Type 10,000 in cell B2 (Face Value). Type .06 in cell B3 (Annual Coupon Rate). Type .09 into cell B4 (Annual Required Return). Type 3 in cell B5 (Years to Maturity). Type 1 in cell B6 (Years to Call).

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Excel formula: Bond valuation example | Exceljet The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. Finally, the required rate of return (discount rate) is assumed to be 8%.

Coupon Rate Template - Realonomics How do you calculate coupon rate in Excel? Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or $1,000, though some municipal bonds have pars of $5,000. ... To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual ...

How to calculate Spot Rates, Forward Rates & YTM in EXCEL The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond ).

Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates

How to calculate bond price in Excel? - ExtendOffice Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is the face value, and you can change them as you need.

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

How Do I Calculate a Discount Rate Over Time Using Excel? May 20, 2022 · Learn how to calculate the discount rate in Microsoft Excel and what the discount factor is. Discover how the discount rate and discount factor compare.

Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Calculation of zero-coupon discount rate for 2 year - Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 calculate coupon rate in excel"