40 ytm zero coupon bond

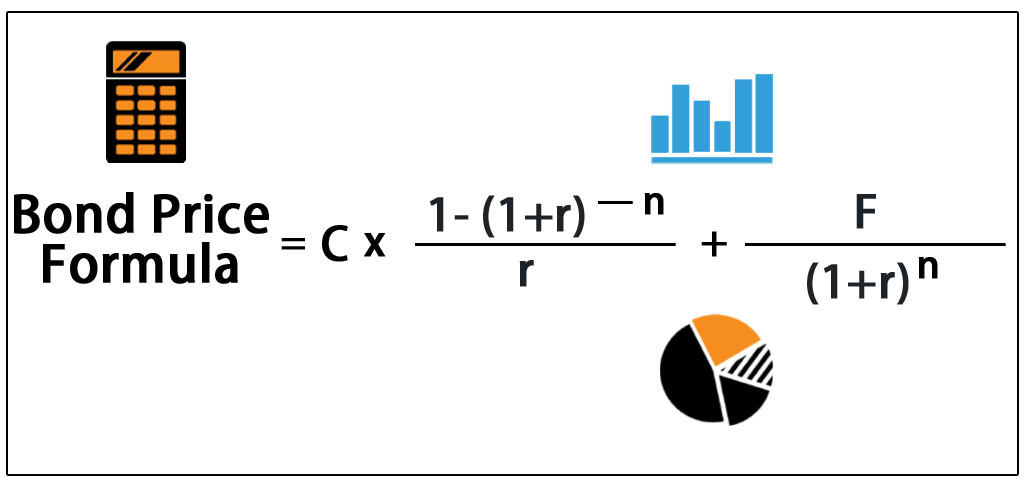

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ... Understanding bonds: sorry for my ignorance; help appreciated. If the bonds purchase price is equal to the par value (face value) (1000), then the coupon rate (interest rate) = current yield = yield to maturity (YTM). If you buy this bond for 1000 and in 3 months they give you back 1000 you make zero.

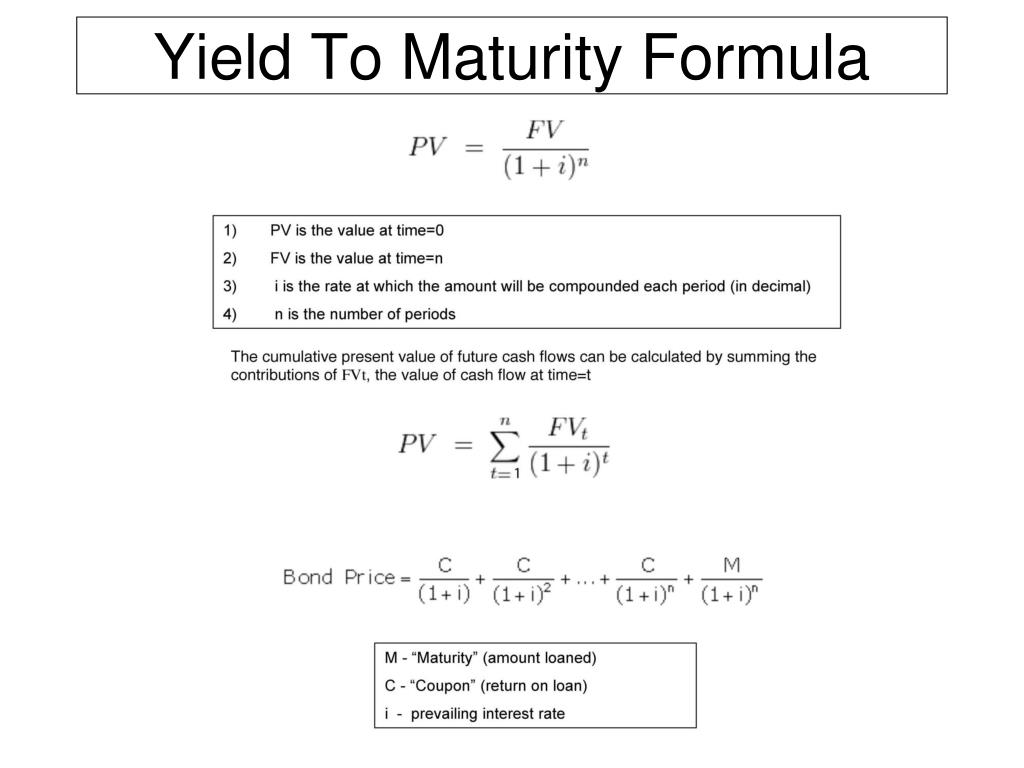

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Ytm zero coupon bond

Bond Yield Definition - Investopedia 01.01.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. OneClass: What is the yield to maturity (YTM) of a zero coupon bond ... What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $940 and maturity of 9 years? Recall that the compounding interval is 6 months and the YTM, like all interest rates, is reported on an annualized basis. Answer + 20 Watch

Ytm zero coupon bond. Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds. For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price ... › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is the Difference Between IRR and the Yield to Maturity? 27.03.2019 · For example, let's say that we buy a bond for $980 with five years until maturity. The bond's face value is $1,000 and its coupon rate is 6%, so … Zero Coupon Bond Calculator - Calculator Academy where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example

Bonds- Price, YTM, Duration - BrainMass US Treasury Notes Coupon Yield to Maturity Zero coupon rate 1 Year 3.25% 3% 3% 2 Year 3.80% 3.25% 3 Year 4.5% 3.5% 4 Year 5% 4% 5 Year 6% 4.5% You can assume that coupon payments are annual and that you are pricing on a coupon day (no accrued interest) and you may ignore basis conventions. Current Yield vs. Yield to Maturity: What's the Difference? - The Balance A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1. Zero Coupon Bond: Calculate the YTM (yield to maturity) Solution Preview 1. Step 1 Look at the value of the bond when it will reach maturity. We have a bond which will be worth $1000 in ten years. 2. Step 2 Check the price that you paid for the bond. We have $459. 3. Step 3 Subtract the number of years between the zero coupon bonds maturity ... Solution Summary Yield To Maturity Calculation Method - CALKUO You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price the face value of the bond the number of years to maturity and the coupon rate. The YTM is the discount rate which equals the present value of promised cash flows to. ... For example a zero-coupon bond with a face value of ...

What is Bond - Meaning, Types & YTM Calculation Process - Scripbox Zero coupon bond: Zero coupon bond is a bond with a zero coupon rate. The bond issuer pays only the principal amount to the investor on maturity. They do not make any coupon payments. However, they are issued at a discount to their par value. The bondholder generates returns once the issuer repays the amount at face value. › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. How To Calculate YTM (Years To Maturity) On A Financial Calculator The calculator will now give you the YTM, or years to maturity, for the bond. Keep in mind that this is only an estimate, as actual YTM can vary depending on market conditions. ... 1500 at maturity when the interest rate have dropped to 2%, the net return will be -151.6% (10-year zero coupon Treasury note of 2019 price is still $918.84 ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

How to calculate yield to maturity in Excel (Free Excel Template) How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Post a Comment for "40 ytm zero coupon bond"