39 is yield to maturity the same as coupon rate

What Is the Difference Between IRR and the Yield to Maturity? 27.03.2019 · For example, let's say that we buy a bond for $980 with five years until maturity. The bond's face value is $1,000 and its coupon rate is 6%, so … Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Yield to put (YTP): same as yield to call, but when the bond holder has the option to sell the bond back to the issuer at a fixed price on specified date. Yield to worst (YTW): when a bond is callable, puttable, exchangeable, or has other features, the yield to worst is the lowest yield of yield to maturity, yield to call, yield to put, and others.

Is yield to maturity the same as coupon rate

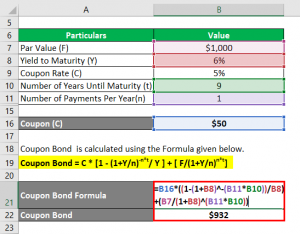

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity (%): The converged upon solution for the yield to maturity of the bond (the internal rate of return) Yield to Maturity (Estimated) (%): The estimated yield to maturity using the shortcut equation explained below, so you can compare how the quick estimate would compare with the converged solution. Current Yield (%): Simple yield based upon current … Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the coupon rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%. How to calculate yield to maturity in Excel (Free Excel Template) 12.09.2021 · Coupon Rate, rate = 6%; Coupons per Year, nper = 4 (quarterly) Years of Maturity = 10; Now, you went to a bond rating agency (Moody’s, S&P, Fitch, etc.) and they rated your bond as AA+. More about the bond rating. But the problem is: when you tried to sell the bond, you see that the same rated bond is selling with 7.5% YTM (yield to maturity ...

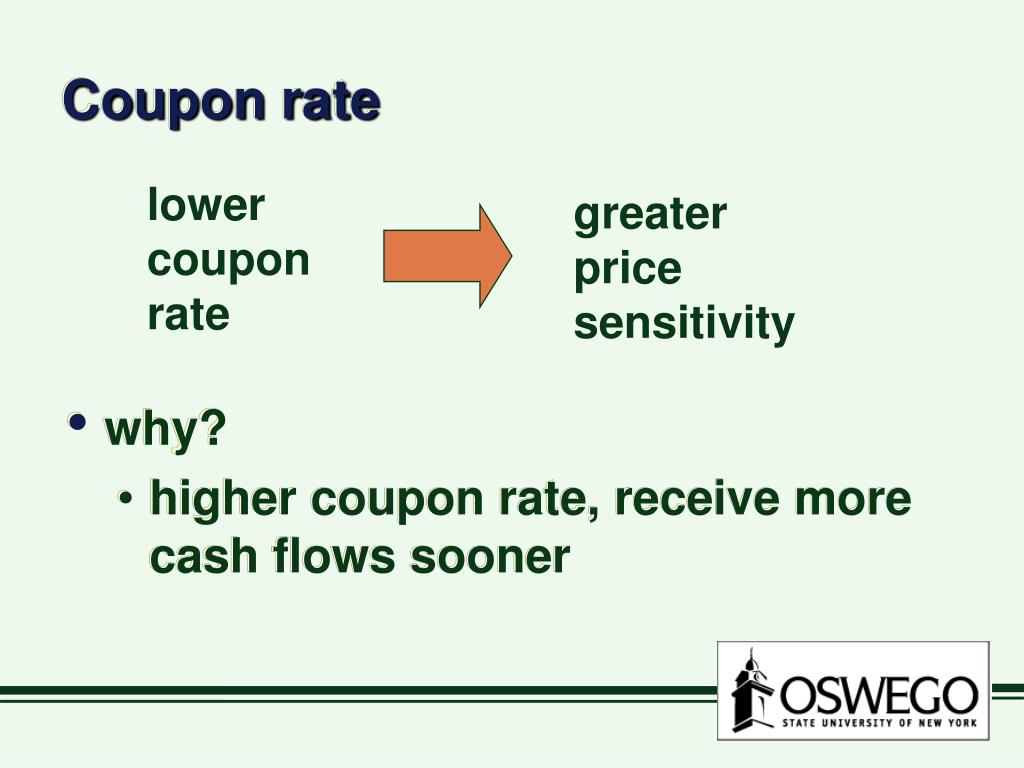

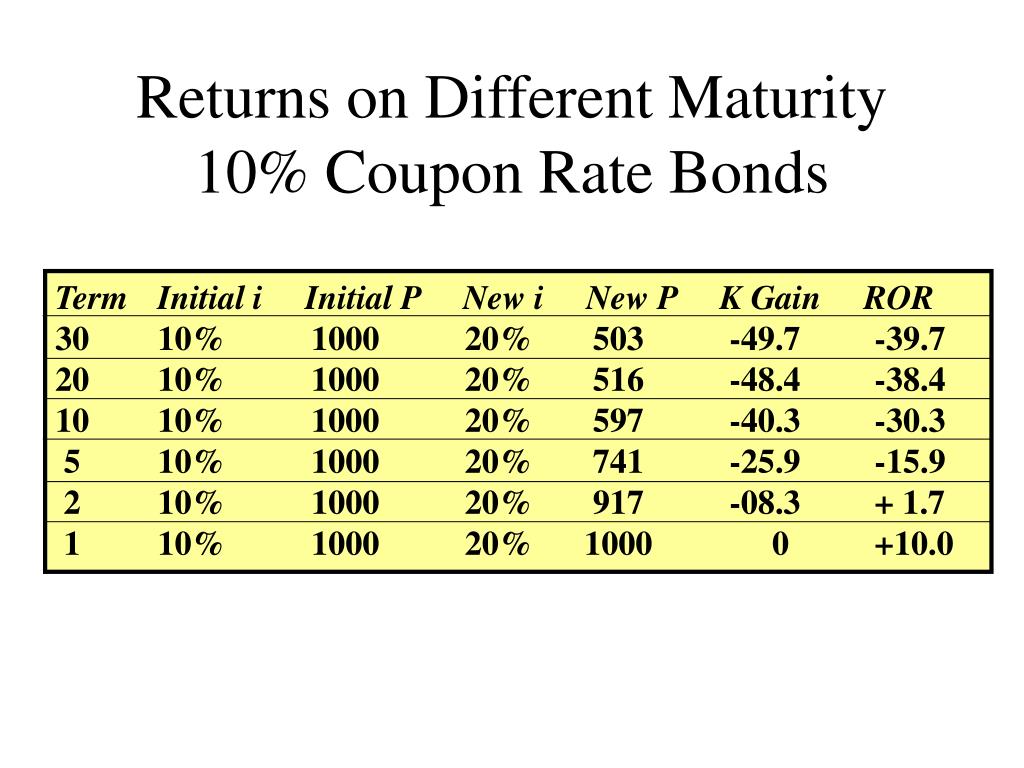

Is yield to maturity the same as coupon rate. What is the approximate yield to maturity of a 14 percent coupon rate ... Robert Walker failed to follow rule 5, which states that low-coupon rate bonds are more sensitive to interest rate changes than high coupon rate bonds (this same principle can be expressed through rule 6 as well in terms of yield to maturity. Low coupon U.S. government bonds have the greatest price sensitivity because there is no credit risk ... Yield to Maturity | Formula, Examples, Conclusion, Calculator 24.03.2021 · C = future cash flows/coupon payments; r = discount rate (the yield to maturity) F = Face value of the bond; n = number of coupon payments; Let’s use the figures from above to work out the value of the bond, assuming the coupon payments are made once per year: Here we can see that the current fair valuation of the bond is $7.15 more than the purchase price, … Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

Solved Which of the following bonds with the same coupon | Chegg.com O a. All bonds have the same price because they have the same coupon rate, time to maturity, and yield to maturity O b. Extendable bonds O c. Convertible bonds O d. Callable bonds O e. Retractable bonds ; Question: Which of the following bonds with the same coupon rate, time to maturity, and yield to maturity has the lowest price? O a. Yield To Maturity Vs. Coupon Rate: What's The Difference? If an investor purchases a bond at par or face worth, the yield to maturity is the same as its coupon charge. If the investor purchases the bond at a reduction, its yield to maturity shall be increased than its coupon charge. A bond bought at a premium may have a yield to maturity that's decrease than its coupon charge. Quick Answer: Is Bond Yield The Same As Yield To Maturity Is yield to maturity the same as discount rate? When bond investors refer to yield, they're usually referring to yield to maturity (YTM). YTM is the sum of: all the interest payments you'll receive (and assumes that you'll reinvest the interest payment at the same rate as the current yield on the bond). › yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · Chances are, you will not arrive at the same value. This is because this yield to maturity calculation is an estimate. Decide whether you are satisfied with the estimate or if you need more precise information. Use the formula = (((/ (+))) /) + / ((+)), where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total … › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond... FIN 221 Exam 1 Flashcards | Quizlet Fish & Chips Inc. has two bond issues outstanding, and both sell for $701.22 and have a par valueof $1000. The first issue has a coupon rate of 8% and 20 years to maturity. The second has an. identical yield to maturity as the first bond, but only 5 years until maturity. Both issues pay interest annually.

EOF

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · At the time it is purchased, a bond's yield to maturity and its coupon rate are the same. As economic conditions change, investors may demand the bond more or less.

Yield to Maturity (YTM) Calculator Yield to Maturity is the index for measuring the attractiveness of bonds. When the price of the bond is low the yield is high and vice versa. YTM is beneficial to the bond buyer because a rising yield would decrease the bond price hence the same amount of interest is paid but for less money. Where the coupon payment refers to the total interest ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Yield to Maturity (YTM) Definition & Example - InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change.

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

Current Yield vs. Yield to Maturity - Investopedia 13.12.2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ...

Post a Comment for "39 is yield to maturity the same as coupon rate"