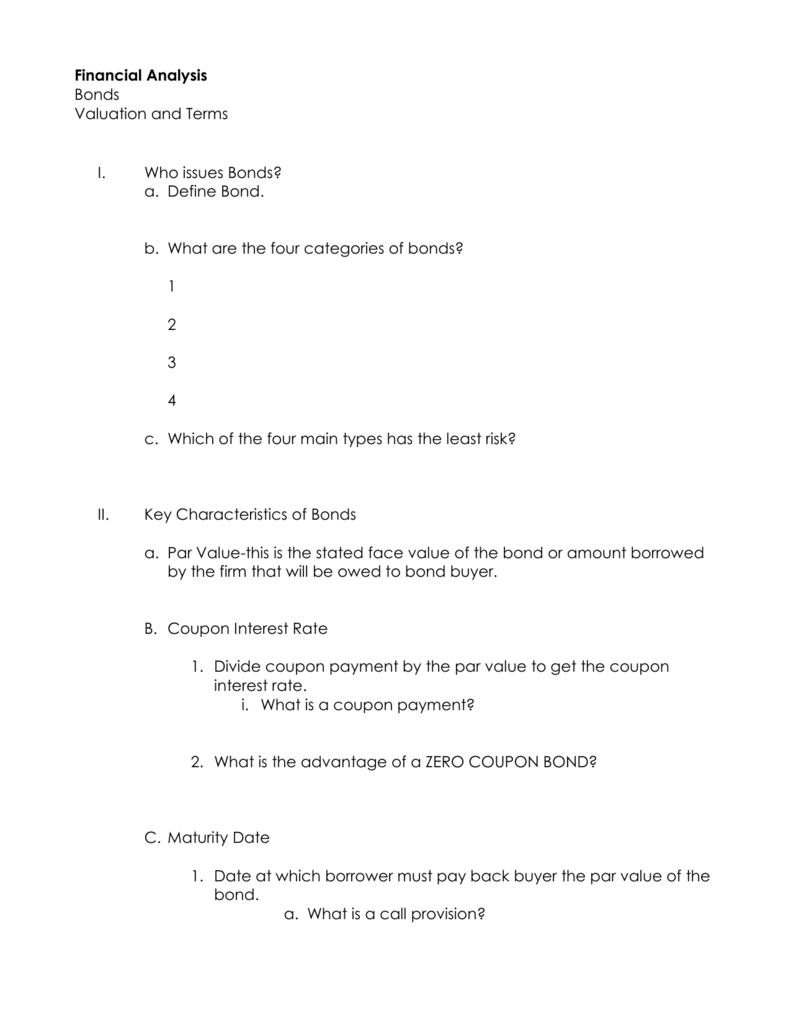

43 advantage of zero coupon bonds

Swiss Re opts for zero-coupon & multi-year notes in new … 07/06/2022 · The Class A tranche are zero coupon discount notes, which at launch were priced at 90% to 90.5% of par and these have a term to December 2022, so only covering the coming hurricane season. What Are High-Yield Bonds and How to Buy Them - NerdWallet Zero-coupon bonds do not make annual payments to the bondholder, but investors benefit when they receive the face value of the bond at maturity. High-yield bonds may also have call provisions,...

SGS Bonds: Information for Individuals Coupon Payment: Semi-annual coupon starting from the month of issue. Paid on the first business day of the month. Transferable: Yes. SGS bonds can be traded on the secondary market - at DBS, OCBC, or UOB branches; or on SGX through securities brokers. Maturity and redemption: No early redemption, but can be sold in the secondary market ...

Advantage of zero coupon bonds

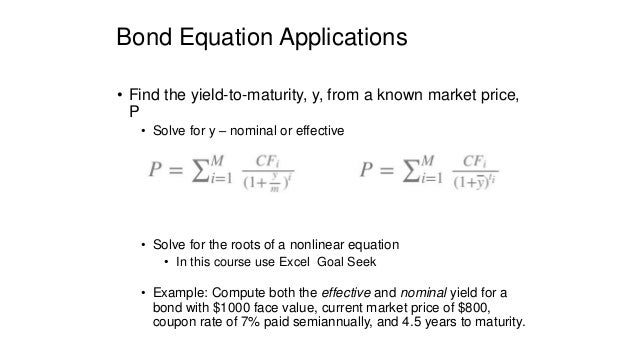

Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... Therefore coupon bonds are more beneficial to investors as they yield higher prices while protecting their principal amount. Figure 6 b (left),d (left) show the variation of bond price with respect... Buying I-Bonds Can Help You Beat Inflation - AARP If you redeem at one year, you'll earn an annualized rate of 4.81 percent. That's far better than any government-guaranteed savings rate around. And that zero percent inflation rate is unlikely. If we hit double-digit inflation, you will get a double-digit return. AARP Membership — $12 for your first year when you sign up for Automatic Renewal Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Advantage of zero coupon bonds. Plain Vanilla Bonds - Meaning, Features, Example, & Advantages A 3-year bond that pays a 5% annual coupon rate (payment semi-annually) with the face value of USD 100.00 Therefore, in this plain vanilla bond - Coupon Rate = 5% of USD 100.00 = USD 5.00 per year Time of coupon payments = semi-annually = USD 2.50 every 6 months (USD 5.00/2) Date of Maturity = 3 years from the date of purchase Zero Coupon 2025 Fund | American Century Investments Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Chapter six: bonds Flashcards | Quizlet Zero coupon bonds are offered at substantial discounts below their par values. True or False. true . Bonds issued by BB&C Communications that have a coupon rate of interest equal to 10 percent currently have a yield to maturity (YTM) equal to 8 percent. Based on this information, it is understood that BB&C's bonds must currently be selling at a premium in the financial markets. …

Bond Yield to Maturity Calculator for Comparing Bonds Zero Coupon Bonds. This is simply any type of bond, government or corporate, that makes no interest payments over its term. Instead, it is sold at a considerable discount to its par value. For example, a $1000 bond might be traded on the open market at a cost of $600, to be paid in full after 10 years. Quite often, standard issue bonds will be stripped of their coupons and sold on … I Bond Pros and Cons: Why They're Such a Sweet Treat Right Now An I Bond is a specific type of bond issued by the U.S. Treasury. I Bonds are designed to protect your money from losing value due to inflation. The bonds pay both: A fixed rate that is set by the Treasury An inflation-adjusted rate that is determined by the rise and fall of inflation - specifically the CPI How Returns on I Bonds Work Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww A zero-coupon bonds pays no interest and trade at a discount to its face value. Get to know its meaning, advantages, price calculation. ... Long-time horizon: The long time horizon of the Zero Coupon bond is a significant advantage for long-term investors. A fixed amount can be availed via a long-term investment without worrying about any market turmoil. Disadvantages of Zero … Government Bonds - Meaning, Types, Advantages & Disadvantages Zero Coupon Bonds As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue price and redemption value. In other words, these bonds are issued at a discount and redeemed at par. Further, these bonds are not issued through auction but created through existing securities.

Types of bonds — AccountingTools A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors to take advantage of a run-up in the price of a company's stock. The conversion option can increase the price that investors are willing to pay for this type of bond. Bond Features All the 21 Types of Bonds | General Features and Valuation | eFM Zero-Coupon Bonds A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

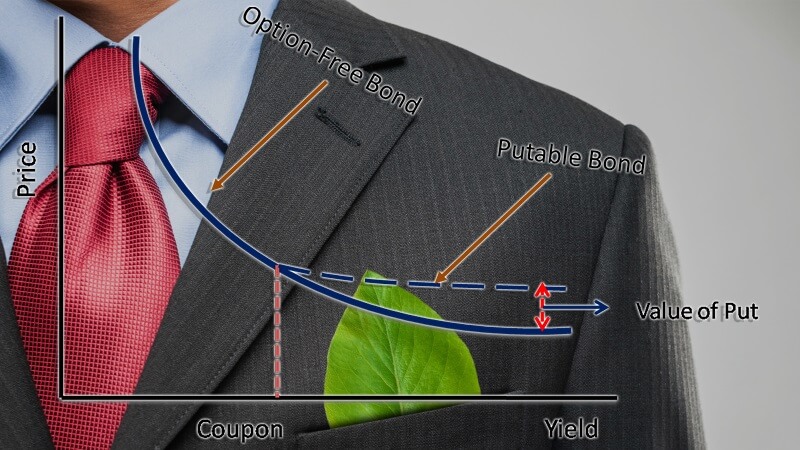

Corporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable

groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

American Century Zero Coupon 2025 Fund Investor Class Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 (k) plans. Close tooltip. American Century Zero Coupon 2025 Fund Investor Class. -1.00%. 2.65%. 2.15%. 2.14%.

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Instead, it is sold at a considerable discount to its par value. For example, a $1000 bond might be traded on the open market at a cost of $600, to be paid in full after 10 years. Quite often, standard issue bonds will be stripped of their coupons and sold on the public market as zero coupon bonds.

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

I Bonds: Are Series I Savings Bonds Worth Buying? - Financial … At the Treasury Direct website, you may purchase I bonds electronically up to a maximum of $10,000 per year per SSN. You can also buy up to an additional $5,000 in the paper I Bonds if you have a tax refund due when you file your federal income tax return.You’d need to complete IRS Form 8888 and include it when you file your tax return. Some individuals make extra …

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

Convertible Bond Definition - Investopedia 06/10/2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Features and Advantages of Treasury Bills | Invest in T-Bills Zero-coupon securities - T-bills provide no interest on the total investments. Treasury bill investor earns the capital gains instead. An individual can buy the bill at the discounted rate and earn the face value rate upon maturity. Advantages: No risk involved - T-bills are issued by RBI and are supported by the Government of India. It is a ...

› fixed-income-bonds › individualCorporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable

Tax Treatment of Bonds and How It Differs From Stocks First, as debt securities, they are often safer than stocks if you need to protect the principal in the event of a bankruptcy or default. 1 Second, they provide a consistent and predictable stream of interest income. As a result, bonds can provide some stability for your portfolio to counter the volatility of stocks, while still generating income.

Types of Bonds - NerdWallet What are the advantages of a particular bond or bond exchange-traded fund? ... Treasury bills carry no interest, or "zero coupon," and a maturity ranging from several days to 52 weeks. Treasury ...

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

› news › swiss-re-opts-for-zeroSwiss Re opts for zero-coupon & multi-year notes in new ... Jun 07, 2022 · The Class A tranche are zero coupon discount notes, which at launch were priced at 90% to 90.5% of par and these have a term to December 2022, so only covering the coming hurricane season.

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

What are Zero Coupon Bonds? Who Should Invest in Them? If your investment portfolio primarily consists of growth investments and you are looking to add diversity to it, then zero coupon bonds can help you secure a guaranteed return for a fixed time period. Finally, these bonds tend to offer great discounts for longer tenures of investment and are perfect for long-term investment plans.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "43 advantage of zero coupon bonds"