45 coupon rate and yield to maturity

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Coupon rate and yield to maturity

Difference Between Coupon Rate And Yield Of Maturity The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The ... humantruth.org /no/tag/yield-to-maturity-and-coupon-rate-differences Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

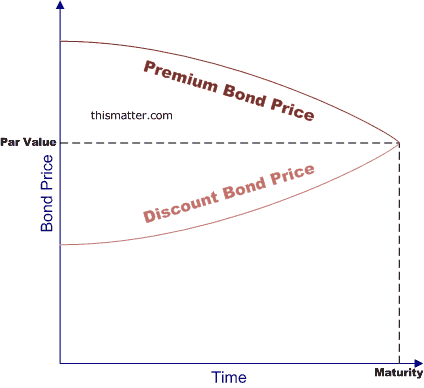

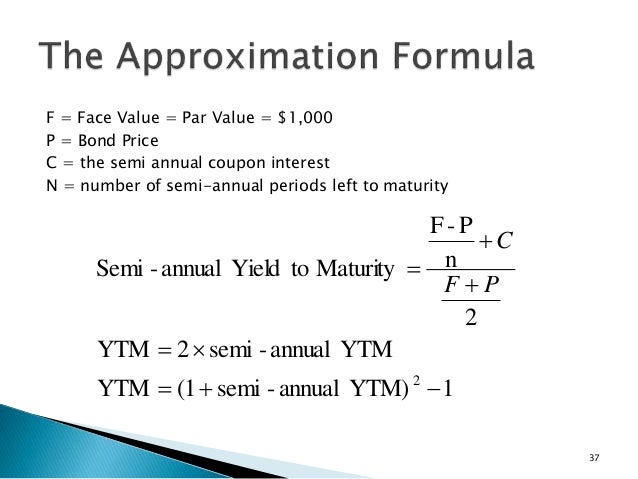

Coupon rate and yield to maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Answered: Suppose a mutual fund that invests in… | bartleby Suppose a mutual fund that invests in bonds purchased a bond when its yield to maturity is higher than the coupon rate. The investor should expect the bond's price to: exceed the face value at maturity. decline over time, reaching par value at maturity. increase over time, reaching par value at maturity. Bond's Maturity, Coupon, and Yield Level | CFA Level 1 ... Longer maturity bond prices are more sensitive to changes in yields than shorter maturity bonds. As shown in the following graph, the price of the 30-year bond increases a lot more than that of the 1-year bond in response to a decrease in interest rates. Coupon Rate Bonds with higher coupon rates are less sensitive to changes in interest rates. Difference Between Yield to Maturity and Coupon Rate ... The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period.

Relationship Between Yield To Maturity And Coupon Rate Of ... Relationship Between Yield To Maturity And Coupon Rate Of A Bond, deals online shopping usa, chef's table deals, kroger coupon snow mountain. View Deal Exclusive: 35% OFF for order with our coupon. Used 315 times. Difference Between Current Yield and Coupon Rate (With ... The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. › yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon RateA coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Coupon vs Yield | Top 5 Differences (with Infographics) Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate Definition. The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. What Is the Difference Between Coupon Rate and Yield-To ... Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming the bond is held until maturity. YTM accounts for various factors like coupon rate, bond prices, and time remaining until maturity, as well as, difference between the face value and price. Difference between YTM and Coupon Rates - Difference Betweenz Coupon rates also play a role in determining a bond's yield (the return that an investor receives on their investment). Difference between YTM and Coupon Rates. YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity.

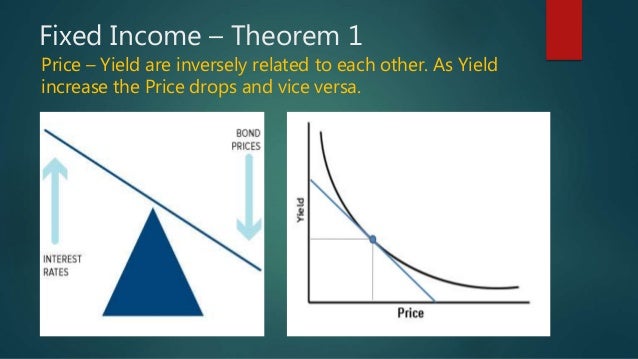

Bond's Price, Coupon Rate, Maturity | CFA Level 1 ... Relationships Among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate. 27 Sep 2019. Price versus Market Discount Rate (Yield-to-maturity) The price of a fixed-rate bond will fluctuate whenever the market discount rate changes. This relationship could be summarized as follows:

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Concept 82: Relationships among a Bond's Price, Coupon ... The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex.

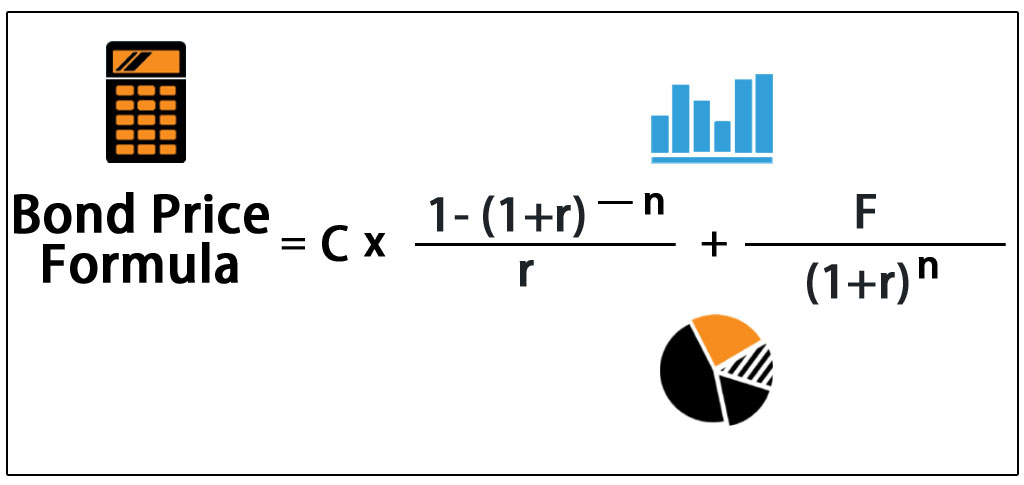

Coupon Rate - Meaning, Calculation and Importance However, the assumption is that the investor holds the bond to maturity, and all the coupon payments are reinvested at the same rate. Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond PV - Current price of the bond t - no. of years to maturity

Yield to Maturity vs Coupon Rate: What's the Difference ... While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

› finance › yield-to-maturityYield to Maturity Calculator | Calculate YTM Oct 05, 2021 · Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ...

Yield to Maturity Calculator | Good Calculators What is the Yield to Maturity? Solution: The yearly coupon payment is $1000 × 6% = $60, the equation takes the following form: 980 = 60×(1 + r)-1 + 60×(1 + r)-2 + 60×(1 + r)-3 + 60×(1 + r)-4 + 60×(1 + r)-5 + 1000×(1 + r)-5. r = 6.48%, The Yield to Maturity (YTM) is 6.48%. You may also be interested in our free Tax-Equivalent Yield Calculator

› terms › cCoupon Rate Definition Sep 05, 2021 · For example, a bond with a par value of $100 but traded at $90 gives the buyer a yield to maturity higher than the coupon rate. Conversely, a bond with a par value of $100 but traded at $110 gives ...

Yield To Maturity Vs. Coupon Rate: What's The Difference? Comparing Yield To Maturity And The Coupon Rate Yield to Maturity (YTM) The YTM is an estimated charge of return. It assumes that the customer of the bond will maintain it till its maturity date, and can reinvest every curiosity cost on the similar rate of interest. Thus, yield to maturity contains the coupon charge inside its calculation.

Coupon rate yield to maturity Coupon rate yield to maturity; Ddr3 4gb 1600mhz laptop; Suicide rates. Suicide rates. Suicide rates Thai baht rate Sulama birlikleri kanunu faiz oranları Yarseli Sulama BirliğiIn , the suicide rate for men was times higher than it was for women. The suicide rate is highest among middle-aged white men, who accounted for almost 70% of all ...

Understanding Coupon Rate and Yield to Maturity of Bonds ... Do note, however, that if your account is entitled to tax exemption then the calculation for coupon pay- ment will exclude the final taxes. Yield-to-Maturity The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates.

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7% then the coupon rate for this security will be 7.5%. Now if this coupon is revised every six months and after six months the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

What is the value of the Ollivon bond on maturity? Explain ... Explain the relationship between the coupon rate and the yield to maturity when a bond is priced at a premium to its face value. Author Joshua Posted on May 23, 2022 Categories Economics Tags Epidemiology, Ollivon bond, Political, Socioeconomic, Therapy Post navigation.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Post a Comment for "45 coupon rate and yield to maturity"